net investment income tax 2021 trusts

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

Investment Expenses What S Tax Deductible Charles Schwab

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

. The adjusted gross income. A the undistributed net investment income or. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

Generally net investment income includes gross income from interest dividends annuities and royalties. April 28 2021 The 38 Net Investment Income Tax. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. B the excess if any of. A comprehensive Federal State International tax resource that you can trust to provide you with answers to your most important tax questions.

1 It applies to individuals families estates and trusts. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

The estates or trusts portion of net investment income tax is calculated on Form.

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

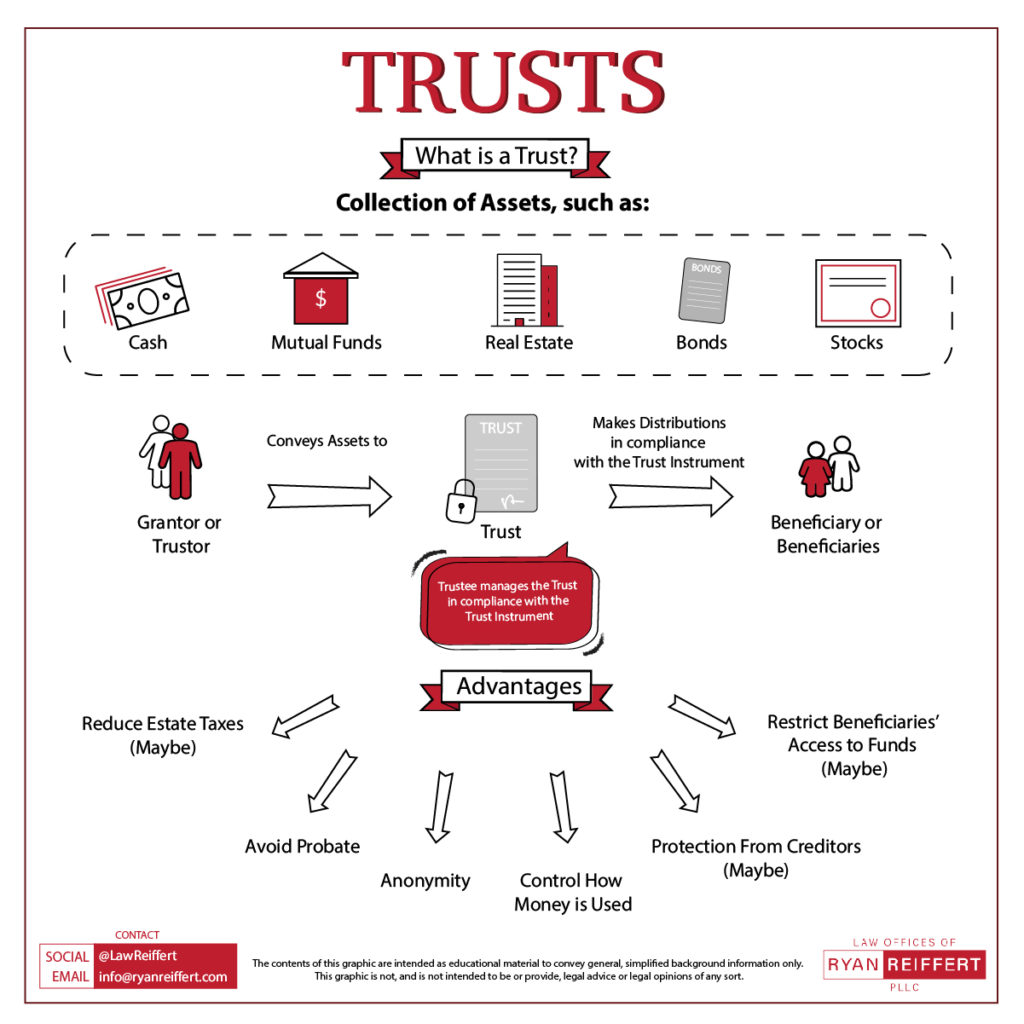

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Is A Section 1231 Gain Subject To Net Income Investment Tax Niit

Turbotax Business Cd Download 2021 2022 Desktop Software File Business Taxes

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc

Investor Education 2021 Tax Rates Schedules And Contribution Limits

Solved You Are Working As An Accountant At A Mid Size Cpa Firm One Of Your Clients Is Bob Jones Bob S Personal Information Is As Follows October Course Hero

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Income Tax Accounting For Trusts And Estates

Understanding Charitable Remainder Trusts

Saving State Income Taxes On Trusts Preservation Family Wealth Protection Planning

What You Need To Know About Capital Gains Tax

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

3 8 Net Investment Income Tax Td T

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate